Home > Investment activities

Investment process

1 Stage

Project concept. At this stage, IC Invest, together with the Partner, approves the structure of participation and financing of the Project. Further, the concept of the Project approved with the Partner is approved at meetings of the authorized bodies (hereinafter – MA) of the Fund and IC Invest. Upon receipt of a positive decision of the MA, the Project proceeds to the next stage.

2 Stage

Comprehensive examination of the project. SK Invest conducts an independent assessment and Due Diligence of the Project (if necessary, with the involvement of independent consultants), a Term Sheet (Agreement on the main conditions of cooperation) is signed with the Partner. Upon receipt of a positive decision of the MA, the Project proceeds to the last stage.

3 Stage

Implementation. At this stage, IC Invest is developing a draft agreement on the joint implementation of the project (hereinafter – JSA), which is also agreed with the Partner. After the agreement of both parties, the DRSP is submitted for approval by the MA SK Invest. Upon receipt of a positive decision, IC Invest concludes approved agreements with the Partner and then finances the Project.

Investment tools

Direct investments

- Participation in the capital of Project Companies

Conditions

- Geography of investments - Republic of Kazakhstan

- Investment period - up to 7 years

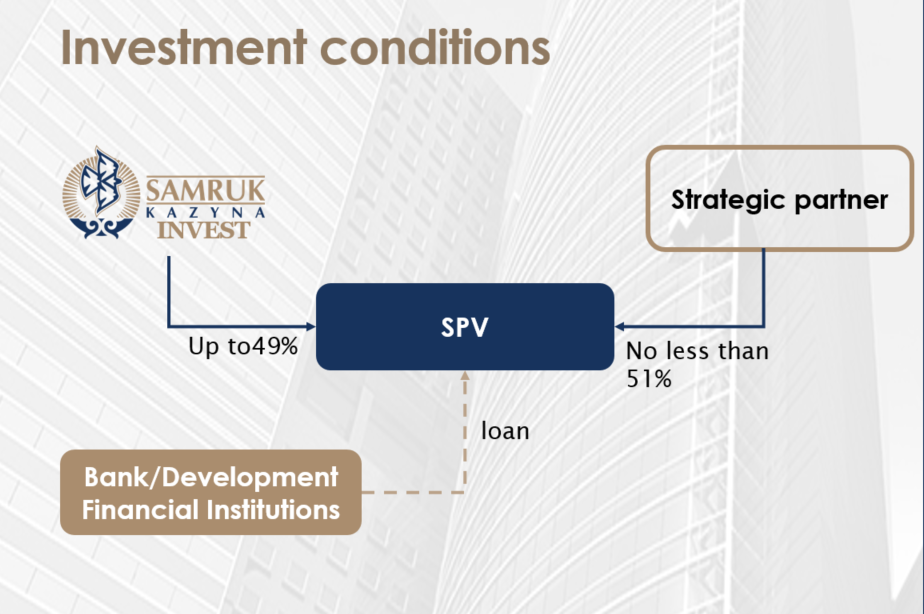

- Pari Passu investments with a strategic partner (up to 49%)

- Requirements for a strategic investor: investments, experience, technology

Priority sectors

Manufacturing industry

Mechanical engineering

Light industry

Food industry

Current projects

Support for the development of SMEs in Kazakhstan by updating fixed assets, technical re-equipment, introduction of new equipment and technologies, increasing the innovative level and economic results of production

- In 2022, the leasing portfolio increased by 13.6%, from 8.1 billion tenge to 9.2 billion tenge.

- In general, the loan portfolio grew 10 times from 2014 to 2022.

- Share of SK Invest (22.52%)

- Implementation period 2014–2015

- Place of implementation Almaty

The project attracted foreign direct investment from the strategic investor UG Energy Limited, as well as project financing from the European Bank for Reconstruction and Development (EBRD) and the Clean Technologies Fund (FCT). This project marked the first project financing transaction between the Samruk-Kazyna JSC group and the EBRD.

- Share of SK Invest (49%)

- In 2022, electricity generation amounted to 154.1 million kWh, with a plan of 155.2 million kWh.

- In total, 964.9 million kWh were generated during operation.

The project was implemented in order to deepen the energy processing market and build a factory in Karaganda for coal enrichment of Ekibastuz and Karaganda deposits. The project has been implemented since 2015 jointly with the Karaganda company Kristall Invest LLP (75%).

Samruk-Kazyna Invest LLP participates in the development of the agro-industrial complex of diversified companies of a vertically integrated production cycle: from the manufacture of feed to the processing of Angus and Herefod beef, milk from the Frisian breed, rice processing and the entire range of product sales

<- Share of SK Invest (49%)

- Implementation period 2021-2023

- Place of implementation Almaty region

- Commissioning 1Q 2022

- Employment - 800

Support for the development of SMEs in Kazakhstan by updating fixed assets, technical re-equipment, introduction of new equipment and technologies, increasing the innovative level and economic results of production

- In 2022, the leasing portfolio increased by 13.6%, from 8.1 billion tenge to 9.2 billion tenge.

- In general, the loan portfolio grew 10 times from 2014 to 2022.

- Share of SK Invest (22.52%)

- Implementation period 2014–2015

- Place of implementation Almaty

The project attracted foreign direct investment from the strategic investor UG Energy Limited, as well as project financing from the European Bank for Reconstruction and Development (EBRD) and the Clean Technologies Fund (FCT). This project marked the first project financing transaction between the Samruk-Kazyna JSC group and the EBRD.

- Share of SK Invest (49%)

- In 2022, electricity generation amounted to 154.1 million kWh, with a plan of 155.2 million kWh.

- In total, 964.9 million kWh were generated during operation.

The project was implemented in order to deepen the energy processing market and build a factory in Karaganda for coal enrichment of Ekibastuz and Karaganda deposits. The project has been implemented since 2015 jointly with the Karaganda company Kristall Invest LLP (75%).

Samruk-Kazyna Invest LLP participates in the development of the agro-industrial complex of diversified companies of a vertically integrated production cycle: from the manufacture of feed to the processing of Angus and Herefod beef, milk from the Frisian breed, rice processing and the entire range of product sales

<- Share of SK Invest (49%)

- Implementation period 2021-2023

- Place of implementation Almaty region

- Commissioning 1Q 2022

- Employment - 800

Project applicants

To submit a project, you can use the feedback form. For convenience, investment project materials can be placed on a cloud storage / disk (Google Drive, Yandex Disk, Cloud Mail.ru, etc.). Below is a list of documents for preliminary consideration of an investment project:

⦁ Application for the project (letter of appeal) from the project initiator (according to the form)

⦁ Business plan (according to the requirements of the Partnership) or a feasibility study of the project.

⦁ Financial model of the project.

⦁ Financial statements of the project initiator and investee for the last 3 years and at the reporting date (audited financial statements if available).

⦁ Independent research and expertise on the project (if any).

⦁ Other materials related to the project.