Main > About us

About us

About us

An investment company owned by the Samruk-Kazyna National Wealth Fund, which is included in the TOP-20 Sovereign Wealth Funds with assets totaling about $70 billion.

Samruk-Kazyna Invest is a financially stable investment company that makes direct investments in projects in the Republic of Kazakhstan together with strategic partners.

Samruk-Kazyna Invest has a Long-term Issuer Default Ratings (IDRs) of ‘BB’ with a Stable Outlook from Fitch Ratings.

History of the company

History of the company

Samruk-Kazyna Invest LLP (hereinafter referred to as SK Invest) was established on July 20, 2007. During the years of foundation, the main goal of the company was to provide expert support for the investment activities of Samruk-Kazyna JSC.

In 2012, the Fund defined new goals and objectives for Samruk-Kazyna Invest – financing investment projects that contribute to the development of import substitution, competitive goods and services in the country.

Over the period from 2012 to 2021, SK Invest has gone through a dynamic path associated with investing in projects in the following sectors of the economy of Kazakhstan: mining and metallurgical complex, mechanical engineering, coal industry, renewable energy, agro-industrial complex, financial services.

Today Samruk-Kazyna Invest is moving to a new stage of development. From 06/15/2021, a new Development Strategy of Samruk-Kazyna Invest LLP for 2021-2030 was approved.

Mission, vision, values

Mission, vision, values

The mission of SK Invest is to attract investments into the economy of the Republic of Kazakhstan and diversify the activities of Samruk-Kazyna JSC to create asset value and obtain a stable level of profit.

Vision – SK Invest is an investment company specializing in direct investments in the country and abroad, with a professional team to attract and implement effective investments.

Achievement of the mission and vision of the Company will be ensured through the implementation of 2 strategic goals:

- Growth in the value of the investment portfolio;

- Diversification of income sources;

The Company’s goals are achieved through the implementation of 4 key priorities:

- Capital Management;

- Breakthrough directions of activity;

- Cooperation with international strategic partners;

- Sustainable development.

Values – SK Invest shares the corporate values of the Fund, expressed in the abbreviation PRIME – Partnership (Partnership), Respect (Respect), Integrity (Honesty), Meritocracy (Meritocracy) and Excellence (Excellence).

Further development is determined taking into account the key priorities of the Fund, global and regional trends in economic development and performance indicators and development of similar investment companies.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Company strategy

Company strategy

The development strategy defines the strategic stages of its implementation and the desire in the long term to move to the active and efficient management of a diversified portfolio of assets, with an increase in the share of international investments to increase the profitability of the portfolio. The partnership considers projects in priority sectors of the economy by attracting investments, creating a transparent and open investment platform for both international and local partners, focusing mainly on the private sector, which is the main driver of sustainable and active development of the economy.

The current portfolio of SK Invest is represented by twelve companies with a total historical investment of the Partnership in the amount of 42.5 billion tenge and a fair value as of December 31, 2021 of 31.5 billion tenge. The Partnership has invested in the following projects:

- construction of a solar power plant;

- solar power plant expansion;

- participation in a leasing company;

- promotion of agricultural products of personal subsidiary plots;

- construction of a coal enrichment plant with a capacity of 500,000 tons per year;

- production of welding electrodes;

- construction of a hydroelectric power station;

- participation in an agricultural holding;

- Şekerbank T.A.Ş.

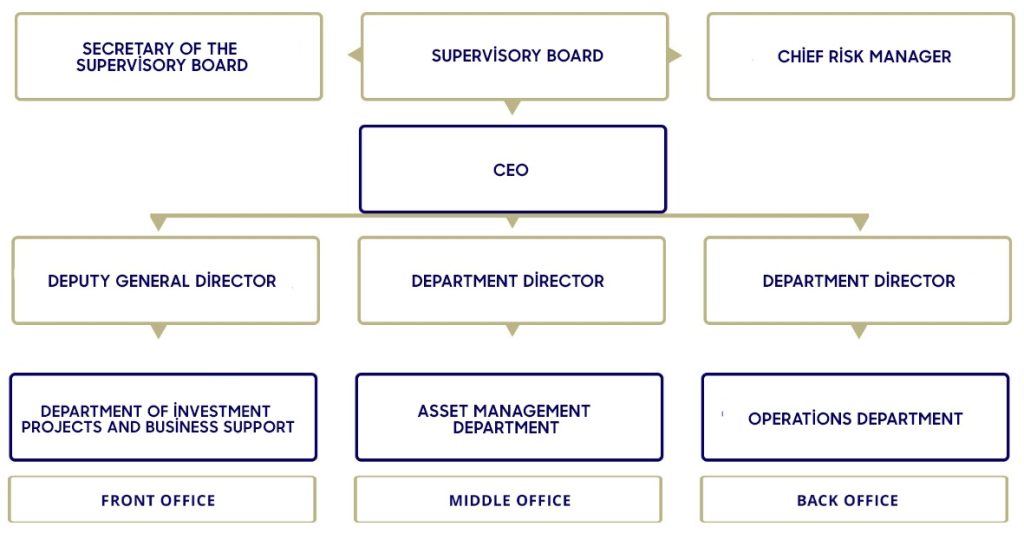

Organizational structure of Samruk Kazyna Invest LLP

Organizational structure of Samruk Kazyna Invest LLP

Our team

Our team

- Sole Shareholder

The Sole Shareholder of the Samruk-Kazyna Invest Limited Liability Partnership is the National Wealth Fund Samruk-Kazyna joint-stock company, relations with which are regulated by the Regulations on interaction with the Sole Participant of Samruk-Kazyna Invest LLP.

The ultimate controlling party of the Partnership is the Government of the Republic of Kazakhstan.

Supervisory Board Information about the Supervisory Board of Samruk-Kazyna Invest LLP The Supervisory Board is the supervisory and control body of the Partnership and has the right to resolve issues that are not assigned by the legislation of the Republic of Kazakhstan, the Charter and internal rules of the Partnership to the exclusive competence of the Sole Participant and the General Director of the Partnership. The Supervisory Board is a collegiate body. The Supervisory Board of the Partnership consists of at least three people and its composition is determined by the Sole Participant.

TUSUPOV AMIR

TUSUPOV AMIR

Chairman of the Supervisory Board of Samruk-Kazyna Invest LLP – Director of the Investment and Business Support Department of Samruk-Kazyna JSC

CFA, FMVA, MSc

Date of election: 06.03.2024 Citizenship: Republic of Kazakhstan

Education:

- 2008-2012 – Karaganda State University named after academician E.A. Buketov, Bachelor of Economics and Business, specialty “State and local government”

- 2012-2014 – Karaganda State University named after Academician E.A. Buketov, Master of Economic Sciences with a degree in “State and local government”

- 2012-2014 – Karaganda Private University “Bolashak”, Bachelor of Laws with a degree in Jurisprudence

- 2014-2016 – University of Porto, Porto, Portugal, Master of Science in Finance

Work Experience:

January 2023 – present, Director of Investment and Business Support Department of Samruk-Kazyna JSC

August 2021 – January 2023, Head of the sector for supporting investment activities of Samruk-Kazyna JSC

May 2018 – August 2021, Senior Analyst, Eurasian Group LLP

August 2017 – April 2018, manager of Baiterek Development JSC

Work and membership in the Boards of Directors / Supervisory Boards of other organizations:

- None

Member of the Presidential Personnel Reserve, recruitment of 2021 (only 50 people)

PIRMAKHANOV SAKEN

PIRMAKHANOV SAKEN

Member of the Supervisory Board of Samruk-Kazyna Invest LLP – Director of the Department of Strategy and Financial and Economic Asset Management of Samruk-Kazyna JSC

Date of election: 27.07.2023 Citizenship: Republic of Kazakhstan

Education:

- 2006-2010 L.N. Gumilyov Eurasian National University, Bachelor of Economics and Business, State and Local Administration

- 2010-2012 Capital University of Economics and Business, Master of Economics

Work experience:

02/2022 – present, Director of the Department of Strategy and Financial and Economic Asset Management of JSC “Samruk-Kazyna”

05/2021 – 02/2022, Director of the Department of Financial and Economic Asset Management of JSC “Samruk-Kazyna”

06/2020 – 05/2021, Senior Manager of the Economic Analysis Sector of the Asset Management Directorate of Samruk-Kazyna JSC

02/2019 – 06/2020, Senior Manager of the sector “Economic Analysis” of the Asset Management Directorate of JSC “Samruk-Kazyna”

01/2018 – 02/2019, Chief Manager of the Department of Analysis and Research of JSC “National Managing Holding “Baiterek”

07/2016- 01/2018 Chief Manager of the Department of Economics and Budget Planning of JSC “National Managing Holding “Baiterek”

08/2013- 07/2016 specialist, leading specialist of JSC “National Scientific Cardiac Surgery Center”

Work and membership in the Boards of Directors/Supervisory Boards of other organizations currently:

- Member of the Board of Directors of JSC Ekibastuzskaya GRES-2 Station;

- Member of the Supervisory Boards of NPP Shulbinskaya HPP LLP, NPP Ust-Kamenogorsk HPP LLP

KUANBAYEVA YELENA

KUANBAYEVA YELENA

Member of the Supervisory Board of Samruk-Kazyna Invest LLP – Senior Manager of the Oil and Gas Assets Department of Samruk-Kazyna JSC

Date of election: 06.03.2023 Citizenship: Republic of Kazakhstan

Education:

- 1990-1995 Gubkin State Academy of Oil and Gas, environmental engineer and technologist in the oil and gas industry with a specialization in environmental protection and rational use of natural resources

Work experience:

07/2023 – present, Senior Manager of the Department of Oil and Gas Assets of Samruk-Kazyna JSC

03/2022 – 07/2023, Head of the Sustainable Development Sector of Samruk-Kazyna JSC

08/2020 – 02/2022, Deputy Chairman of the Board of the NAO “International Center for Green Technologies and Investment Projects”

09/2015 – 06/2020, Director of the Department of Corporate Management of Occupational Safety, Industrial Safety and Environmental Protection of JSC NC “KazMunayGas”

04/2014 – 04/2015, Senior Advisor on Environmental Policy of Tengizchevroil LLP

Aslan Shangutov

Aslan Shangutov

CEO

Citizen of the Republic of Kazakhstan.

Higher education: In 2005, he graduated from the Kazakh Institute of Management Economics and Forecasting (KIMEP) with a degree in business administration and finance. In 2007, he completed a master’s degree in finance at The George Washington University (GWU). In 2019, he earned an MBA from the Massachusetts Institute of Technology (MIT).

He has many years of experience in the financial industry in the field of investment management and digitalization of business.

He started his career in Kazyna Capital Management JSC (QIC), then continued his work in Samruk-Kazyna SWF JSC, and then held management positions in the group of companies of Samruk-Kazyna SWF JSC: NAC Kazatomprom JSC, Temirbank JSC.

Since 2012, he continued his career in management positions in the financial sector of second-tier banks and financial development institutions: Entrepreneurship Development Fund “DAMU” JSC, National Bank of Kazakhstan, Kazkommertsbank JSC, Amanat Insurance Company.

Daniyar Myrzakhmetov

Director of Asset Management Department

BSc, MA

Citizen of the Republic of Kazakhstan. Born June 10, 1983.

Higher education: In 2005 he graduated from the KIMEP University with a degree in business administration and accounting. In 2007, he graduated from KIMEP with a master’s degree in financial analysis (without a thesis).

He has 15 years of experience in finance, investment, marketing, including in international companies. He began his career in 2007 at KazInvestBank JSC.

- 2007 – 2012 – experience in second-tier banks, private consulting, German concern Bayer.

- 2012 – 2015 – held managerial positions in private companies.

- 2015 – 2019 – held senior positions at Kazatomprom-Damu LLP, as well as at Tau-Ken Samruk NMC JSC.

- 2019 – 2022 – worked at Samruk-Kazyna JSC in the sector for finding initiatives (RES projects, Direct Investment Funds, MMC projects).

- Since December 1, 2022, he has been the Director of the Asset Management Department of Samruk-Kazyna Invest LLP.

Fluent in English.

Nurgazinov Galym

Head of the Project Analysis and Structuring Sector

g.nurgazinov@skinvest.kz

Yelaman Alipbayev

Project Leader

ye.alipbayev@skinvest.kz

- Sole Shareholder The Sole Shareholder of the Samruk-Kazyna Invest Limited Liability Partnership is the National Wealth Fund Samruk-Kazyna joint-stock company, relations with which are regulated by the Regulations on interaction with the Sole Participant of Samruk-Kazyna Invest LLP. The ultimate controlling party of the Partnership is the Government of the Republic of Kazakhstan.

Supervisory Board Information about the Supervisory Board of Samruk-Kazyna Invest LLP The Supervisory Board is the supervisory and control body of the Partnership and has the right to resolve issues that are not assigned by the legislation of the Republic of Kazakhstan, the Charter and internal rules of the Partnership to the exclusive competence of the Sole Participant and the General Director of the Partnership. The Supervisory Board is a collegiate body. The Supervisory Board of the Partnership consists of at least three people and its composition is determined by the Sole Participant.

TUSUPOV AMIR

TUSUPOV AMIR

Chairman of the Supervisory Board of Samruk-Kazyna Invest LLP – Director of the Investment and Business Support Department of Samruk-Kazyna JSC

CFA, FMVA, MSc

Date of election: 06.03.2024 Citizenship: Republic of Kazakhstan

Education:

- 2008-2012 – Karaganda State University named after academician E.A. Buketov, Bachelor of Economics and Business, specialty “State and local government”

- 2012-2014 – Karaganda State University named after Academician E.A. Buketov, Master of Economic Sciences with a degree in “State and local government”

- 2012-2014 – Karaganda Private University “Bolashak”, Bachelor of Laws with a degree in Jurisprudence

- 2014-2016 – University of Porto, Porto, Portugal, Master of Science in Finance

Work Experience:

January 2023 – present, Director of Investment and Business Support Department of Samruk-Kazyna JSC

August 2021 – January 2023, Head of the sector for supporting investment activities of Samruk-Kazyna JSC

May 2018 – August 2021, Senior Analyst, Eurasian Group LLP

August 2017 – April 2018, manager of Baiterek Development JSC

Work and membership in the Boards of Directors / Supervisory Boards of other organizations:

- None

Member of the Presidential Personnel Reserve, recruitment of 2021 (only 50 people)

PIRMAKHANOV SAKEN

PIRMAKHANOV SAKEN

Member of the Supervisory Board of Samruk-Kazyna Invest LLP – Director of the Department of Strategy and Financial and Economic Asset Management of Samruk-Kazyna JSC

Date of election: 27.07.2023 Citizenship: Republic of Kazakhstan

Education:

- 2006-2010 L.N. Gumilyov Eurasian National University, Bachelor of Economics and Business, State and Local Administration

- 2010-2012 Capital University of Economics and Business, Master of Economics

Work experience:

02/2022 – present, Director of the Department of Strategy and Financial and Economic Asset Management of JSC “Samruk-Kazyna”

05/2021 – 02/2022, Director of the Department of Financial and Economic Asset Management of JSC “Samruk-Kazyna”

06/2020 – 05/2021, Senior Manager of the Economic Analysis Sector of the Asset Management Directorate of Samruk-Kazyna JSC

02/2019 – 06/2020, Senior Manager of the sector “Economic Analysis” of the Asset Management Directorate of JSC “Samruk-Kazyna”

01/2018 – 02/2019, Chief Manager of the Department of Analysis and Research of JSC “National Managing Holding “Baiterek”

07/2016- 01/2018 Chief Manager of the Department of Economics and Budget Planning of JSC “National Managing Holding “Baiterek”

08/2013- 07/2016 specialist, leading specialist of JSC “National Scientific Cardiac Surgery Center”

Work and membership in the Boards of Directors/Supervisory Boards of other organizations currently:

- Member of the Board of Directors of JSC Ekibastuzskaya GRES-2 Station;

- Member of the Supervisory Boards of NPP Shulbinskaya HPP LLP, NPP Ust-Kamenogorsk HPP LLP

KUANBAYEVA YELENA

KUANBAYEVA YELENA

Member of the Supervisory Board of Samruk-Kazyna Invest LLP – Senior Manager of the Oil and Gas Assets Department of Samruk-Kazyna JSC

Date of election: 06.03.2023 Citizenship: Republic of Kazakhstan

Education:

1990-1995 Gubkin State Academy of Oil and Gas, environmental engineer and technologist in the oil and gas industry with a specialization in environmental protection and rational use of natural resources

Work experience:

07/2023 – present, Senior Manager of the Department of Oil and Gas Assets of Samruk-Kazyna JSC

03/2022 – 07/2023, Head of the Sustainable Development Sector of Samruk-Kazyna JSC

08/2020 – 02/2022, Deputy Chairman of the Board of the NAO “International Center for Green Technologies and Investment Projects”

09/2015 – 06/2020, Director of the Department of Corporate Management of Occupational Safety, Industrial Safety and Environmental Protection of JSC NC “KazMunayGas”

04/2014 – 04/2015, Senior Advisor on Environmental Policy of Tengizchevroil LLP

Aslan Shangutov

Aslan Shangutov

CEO

Citizen of the Republic of Kazakhstan.

Higher education: In 2005, he graduated from the Kazakh Institute of Management Economics and Forecasting (KIMEP) with a degree in business administration and finance. In 2007, he completed a master’s degree in finance at The George Washington University (GWU). In 2019, he earned an MBA from the Massachusetts Institute of Technology (MIT).

He has many years of experience in the financial industry in the field of investment management and digitalization of business.

He started his career in Kazyna Capital Management JSC (QIC), then continued his work in Samruk-Kazyna SWF JSC, and then held management positions in the group of companies of Samruk-Kazyna SWF JSC: NAC Kazatomprom JSC, Temirbank JSC.

Since 2012, he continued his career in management positions in the financial sector of second-tier banks and financial development institutions: Entrepreneurship Development Fund “DAMU” JSC, National Bank of Kazakhstan, Kazkommertsbank JSC, Amanat Insurance Company.

Myrzakhmetov Daniyar

Director of Asset Management Department

BSc, MA

Citizen of the Republic of Kazakhstan. Born June 10, 1983.

Higher education: In 2005 he graduated from the KIMEP University with a degree in business administration and accounting. In 2007, he graduated from KIMEP with a master’s degree in financial analysis (without a thesis).

He has 15 years of experience in finance, investment, marketing, including in international companies. He began his career in 2007 at KazInvestBank JSC.

- 2007 – 2012 – experience in second-tier banks, private consulting, German concern Bayer.

- 2012 – 2015 – held managerial positions in private companies.

- 2015 – 2019 – held senior positions at Kazatomprom-Damu LLP, as well as at Tau-Ken Samruk NMC JSC.

- 2019 – 2022 – worked at Samruk-Kazyna JSC in the sector for finding initiatives (RES projects, Direct Investment Funds, MMC projects).

- Since December 1, 2022, he has been the Director of the Asset Management Department of Samruk-Kazyna Invest LLP.

Fluent in English.

Nurgazinov Galym

Head of the Project Analysis and Structuring Sector

g.nurgazinov@skinvest.kz

Yelaman Alipbayev

Project Leader

ye.alipbayev@skinvest.kz

Financial Statements

Financial Statements

Annual reporting

Annual reporting

Information disclosure

Information disclosure

Regulations on interaction with the Sole Participant

Information about the external auditor

Information about the external auditor

An external independent auditor of Samruk-Kazyna The investor is PwC (PricewaterhouseCoopers LLP).

An external independent auditor of Samruk-Kazyna The investor is PwC (PricewaterhouseCoopers LLP).

An external independent auditor of Samruk-Kazyna The investor is PwC (PricewaterhouseCoopers LLP).

Information about the remuneration paid by Samruk-Kazyna LLP Invest” to an audit organization for the provision of audit and non-audit services for 2022

Information on remuneration paid by Samruk-Kazyna Invest LLP to an audit organization for the provision of audit and non-audit services for 2023

Risk management

Risk management system

Samruk-Kazyna Invest LLP (hereinafter referred to as SK Invest) pays great attention to risk management as a key component of the corporate governance system of Samruk-Kazyna JSC (hereinafter referred to as the Fund), aimed at timely identification and taking measures to reduce the level of risks that may negatively affect the value and reputation of SK Invest. Risk management in the Company is carried out by implementing a risk management system (hereinafter referred to as RMS) at all levels of the Company. The RMS is a set of interrelated elements combined into a single process, within which the Supervisory Board of the Company, management and employees, each at their own level, participate in identifying potential events that may affect the Company’s activities, as well as in managing these events within an acceptable risk level for the Sole participant of IC Invest – the Fund. You can learn more about the RMS of IC Invest by reading the Risk Management Policy of Samruk-Kazyna Invest LLP in the Corporate Documents subsection.

Anti-corruption

Anti-corruption

Hotline of Samruk-Kazyna JSC You can report any violations of the Code of Conduct, including corruption, fraud, unethical behavior, discrimination. We consider 100% of applications and guarantee confidentiality and anonymity.

- Hotline: 8 800 080 47 47

- WhatsApp: 8 771 191 88 16

- Internet portal: sk-hotline.kz

- E-mail: mail@sk-hotline.kz

Hotline

You can report any violations of the Code of Conduct, including facts of corruption, discrimination, unethical behavior and other violations

We guarantee

Конфиденциальность и анонимность. Рассмотрение 100% обращение.

- Hotline: 8 800 080 47 47

- Whatsapp number: 8 771 191 88 16

- Internet portal: sk-hotline.kz

- E-mail: mail@sk-hotline.kz

Hotline

You can report any violations of the Code of Conduct, including facts of corruption, discrimination, unethical behavior and other violations

We guarantee

Confidentiality and anonymity. Consideration 100% appeal.